Amur Capital Management Corporation - The Facts

Amur Capital Management Corporation - The Facts

Blog Article

The 2-Minute Rule for Amur Capital Management Corporation

Table of Contents8 Simple Techniques For Amur Capital Management CorporationAmur Capital Management Corporation for BeginnersUnknown Facts About Amur Capital Management CorporationRumored Buzz on Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For AnyoneThe 7-Minute Rule for Amur Capital Management Corporation

International straight financial investment (FDI) happens when a private or company owns at the very least 10% of an international company. When investors possess less than 10%, the International Monetary Fund (IMF) defines it simply as component of a stock profile. Whereas a 10% ownership in a company does not provide an individual capitalist a managing rate of interest in a foreign firm, it does enable influence over the firm's administration, operations, and general policies.Firms in establishing nations require multinational financing and expertise to increase, give framework, and assist their international sales. These international companies require private financial investments in facilities, power, and water in order to boost tasks and salaries (passive income). There are various levels of FDI which range based on the kind of companies entailed and the reasons for the financial investments

The Definitive Guide for Amur Capital Management Corporation

Other kinds of FDI consist of the acquisition of shares in a connected venture, the unification of a wholly-owned company, and involvement in an equity joint endeavor throughout global borders (https://issuu.com/amurcapitalmc). Investors who are intending to engage in any kind of sort of FDI may be sensible to weigh the investment's advantages and downsides

FDI improves the production and solutions field which results in the creation of jobs and aids to reduce joblessness rates in the country. Increased employment translates to greater revenues and outfits the populace with even more purchasing power, enhancing the total economic climate of a country. Human capital included the understanding and proficiency of a workforce.

The development of 100% export oriented systems aid to assist FDI investors in boosting exports from various other nations. The flow of FDI right into a nation converts right into a constant circulation of fx, assisting a country's Central Bank keep a flourishing get of fx which leads to steady currency exchange rate.

Amur Capital Management Corporation - Questions

Foreign straight financial investments can often influence exchange rates to the advantage of one country and the hinderance of another. When financiers spend in foreign areas, they might discover that it is extra expensive than when items are exported.

Thinking about that international direct financial investments might be capital-intensive from the point of view of the capitalist, it can in some cases be really risky or economically non-viable. Consistent political changes can cause expropriation. In this case, those nations' governments will certainly have control over investors' residential or commercial property and possessions. Numerous third-world nations, or at least those with history of colonialism, worry that international direct investment would certainly cause some type of contemporary financial manifest destiny, which reveals host nations and leave them prone to international firms' exploitation.

Stopping the accomplishment space, enhancing health and wellness outcomes, increasing profits and offering a high rate of financial returnthis one-page record sums up the benefits of investing in quality very early youth education for disadvantaged children. This record is often shared with policymakers, supporters and the media to make the situation for early childhood education and learning.

7 Easy Facts About Amur Capital Management Corporation Shown

Think about just how gold will fit your monetary objectives and long-term investment strategy prior to you spend - accredited investor. Getty Images Gold is typically thought about a solid property for and as a in times of uncertainty. The valuable metal can be appealing with durations of financial unpredictability and recession, in addition to when rising cost of living runs high

The Ultimate Guide To Amur Capital Management Corporation

"The suitable time to develop and assign a design profile would remain in less volatile and difficult times when emotions aren't controlling decision-making," says Gary Watts, vice head of state and economic consultant at Wealth Improvement Team. Besides, "Sailors clothing and provision their watercrafts before the storm."One method to determine if gold is right for you is by investigating its benefits and downsides as a financial investment choice.

So, if you have cash money, you're successfully shedding money. Gold, on the various other hand, may. Not everyone agrees and gold may not constantly rise when inflation rises, but it might still be a financial investment factor.: Purchasing gold can possibly aid investors get with uncertain economic conditions, taking into consideration the during these periods.

The Facts About Amur Capital Management Corporation Revealed

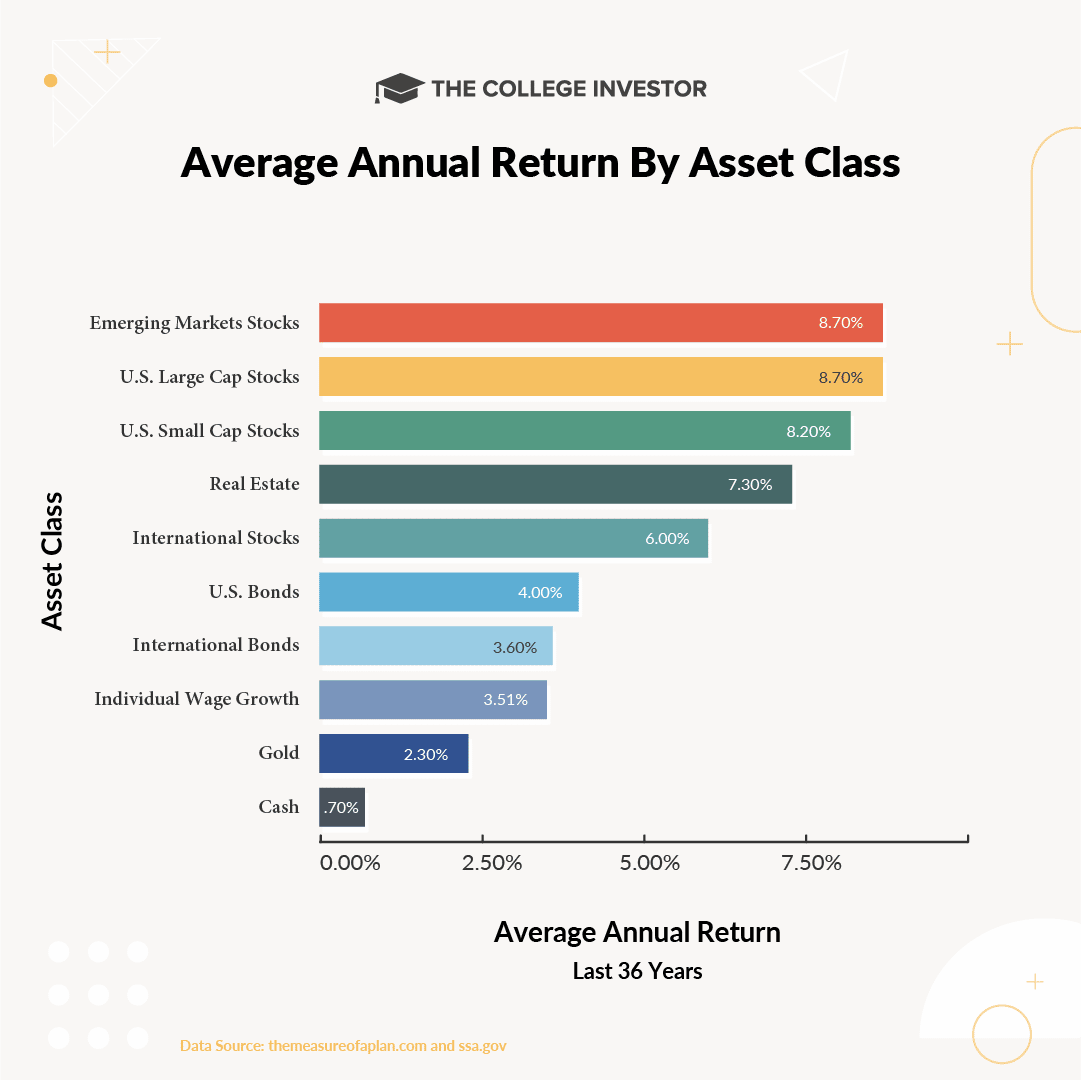

That doesn't suggest gold will always go up when the economic climate looks unstable, however maybe helpful for those who plan ahead.: Some investors as a way to. Rather than having every one of your cash linked up in one property class, various can possibly assist you better manage risk and return.

If these are several of the advantages you're trying to find then begin purchasing gold today. While gold can help include balance and protection for some financiers, like many investments, there are likewise runs the risk of to keep an eye out for. Gold could exceed other properties during specific durations, while not holding up also to long-term rate gratitude.

Report this page